What Is Carriage Inwards

Definitions and meanings Carriage inwards: Carriage inwards is the transportation cost incurred on goods purchased by a business. When an entity purchases goods or raw materials, it need to transport them from seller's factory or warehouse to its own factory, warehouse or store.

Carriage Inwards in Statement AllenhasCannon

Carriage inwards refers to the transport costs that you are paying for getting something delivered to your business from a supplier: in other words, its the transport costs associated with an asset you purchased, and in particular, stock or goods. Carriage Inwards is also known as Freight on Purchases or Freight In.

Revision thread Accounting (AQA) Unit ACCN1 10 January 2012 (pm) Page 4 The Student Room

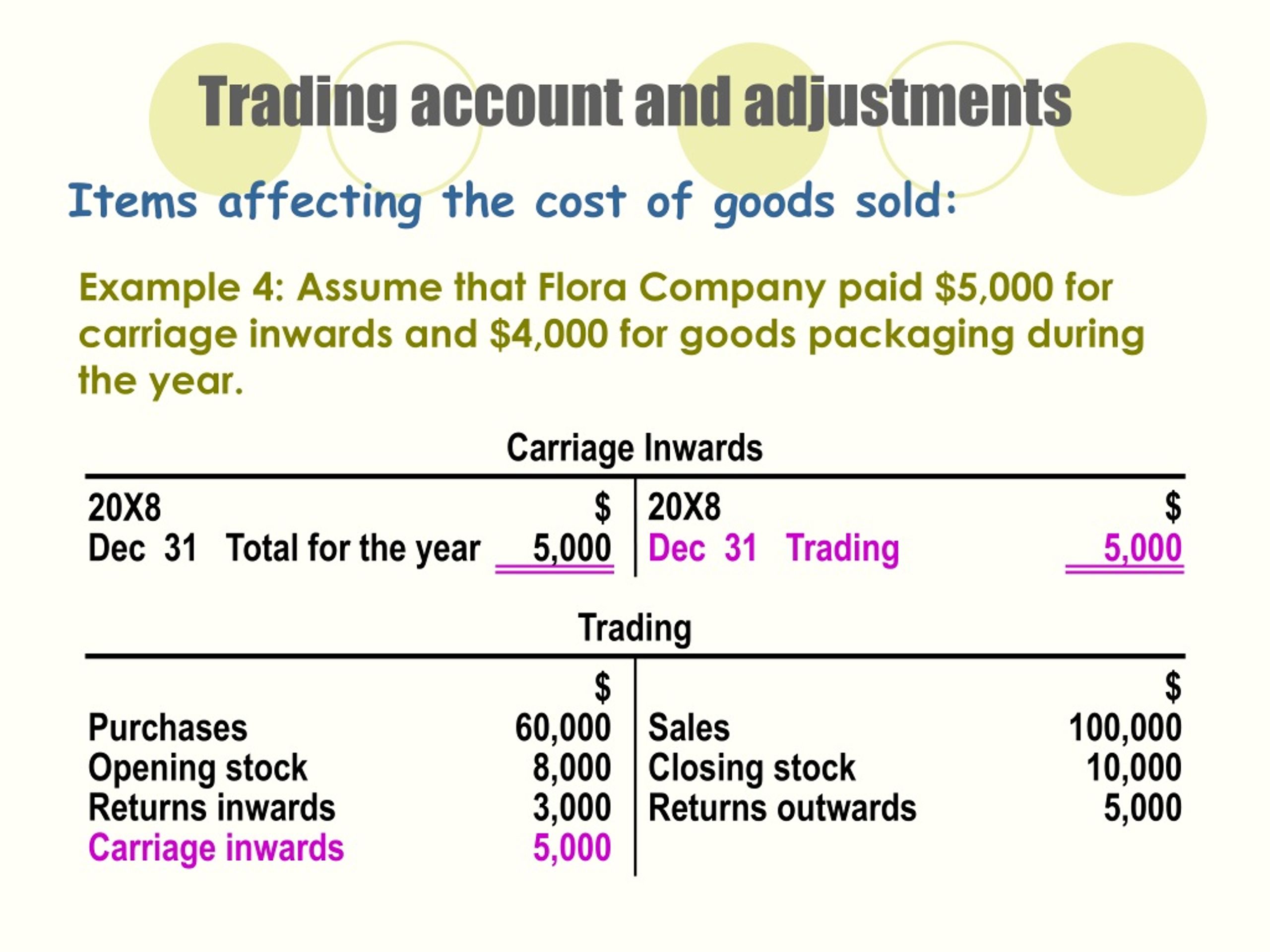

Carriage-in is a part of the cost of the purchased goods (cost of goods sold, cost of inventory, and cost of the items available). Carriage inwards in income statement is an expense that is incurred while transporting goods from the supplier's warehouse to the buyer's warehouse.

PPT The Trading and Profit and Loss Account and the Balance Sheet PowerPoint Presentation ID

It refers to the cost incurred when an inward flow of goods for the business occurs. Carriage inwards cost is typically paid by buyers. Another term often used for carriage inwards is Freight In. Carriage Inwards is borne by the supplier and in accounting, it is added to the cost of purchased products.

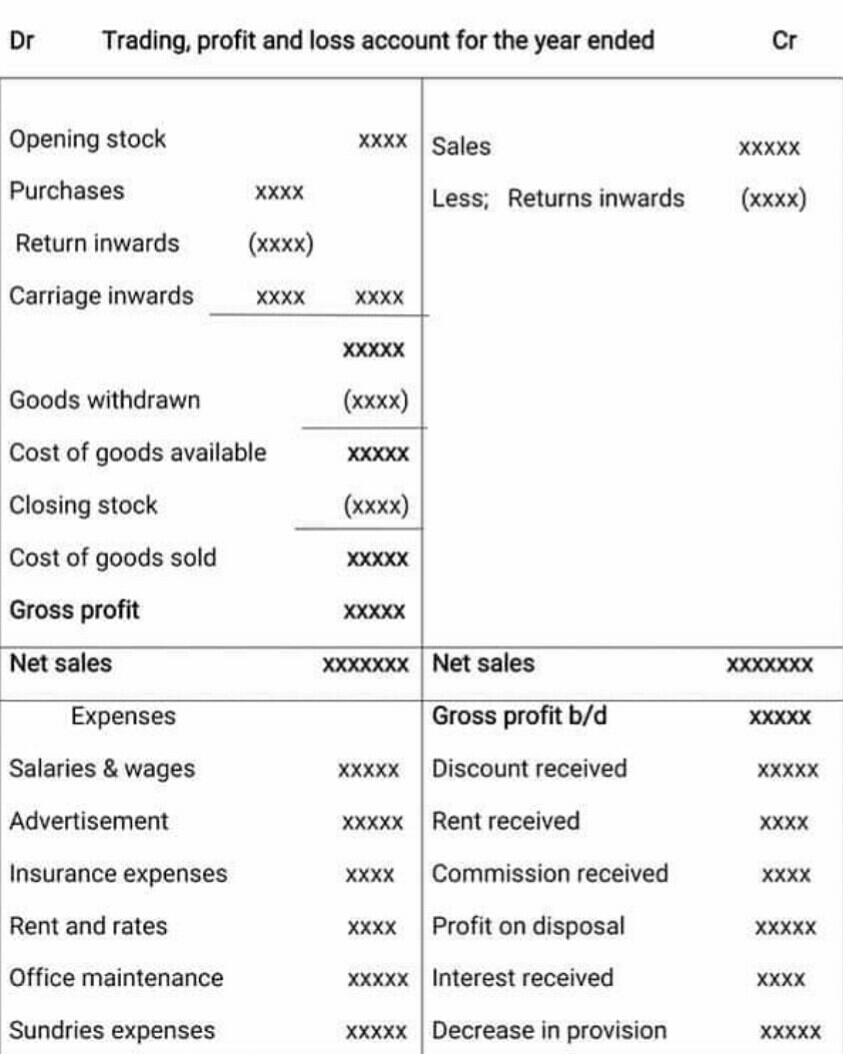

The trading account Gross profit A trading account

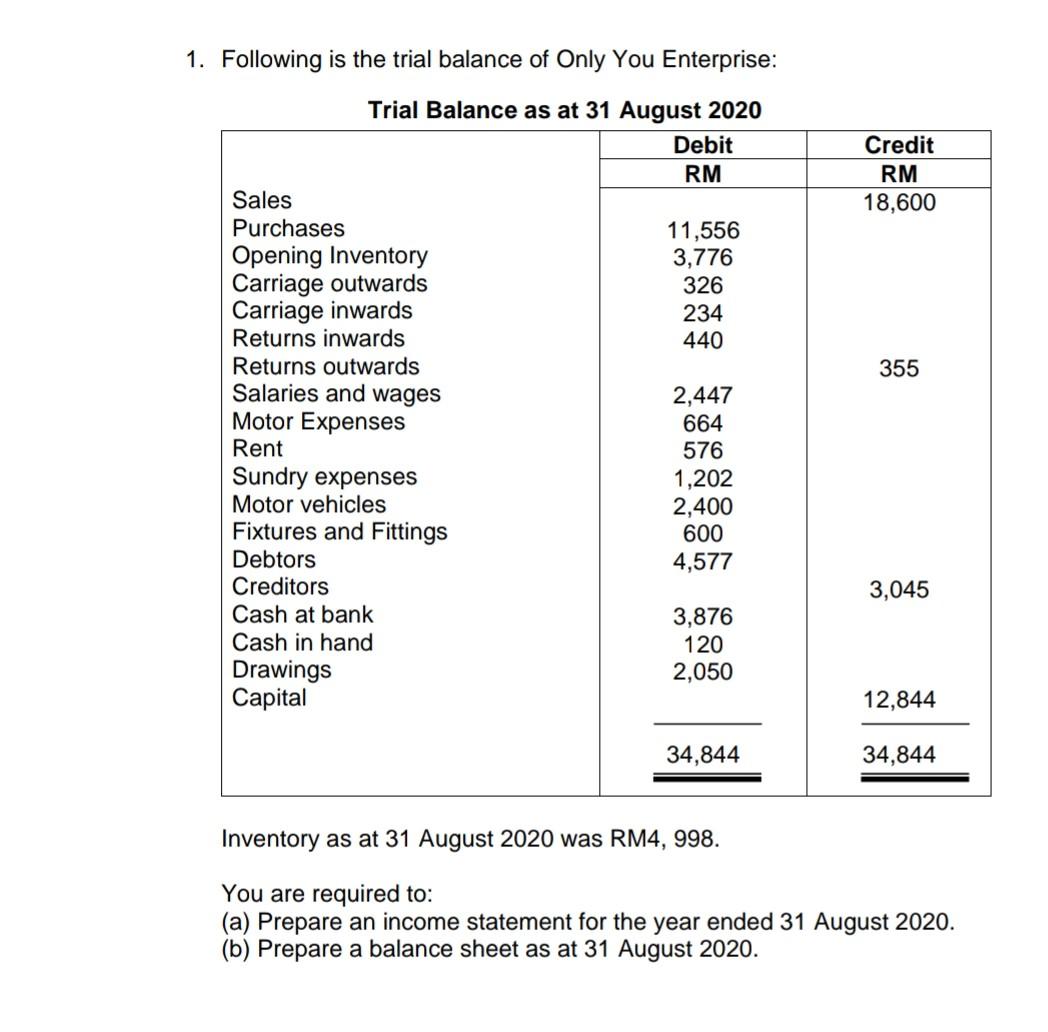

Carriage inwards in trial balance and Carriage outwards in trial balance are both treated as just another expense. Here is a list of all major type of accounts in a business and their usual ledger balances. All expense line items such as carriage inwards and carriage outwards would present a debit balance in the trial balance.

Stock Records Carriage Inwards Material Cost Cost Accounting YouTube

Carriage inward refers to the cost of transportation incurred by a business to bring goods or materials from suppliers to the business premises or warehouses. In accounting and finance, it is treated as a part of the inventory cost or cost of goods sold (COGS), depending on the accounting method used. Importance of carriage inward:

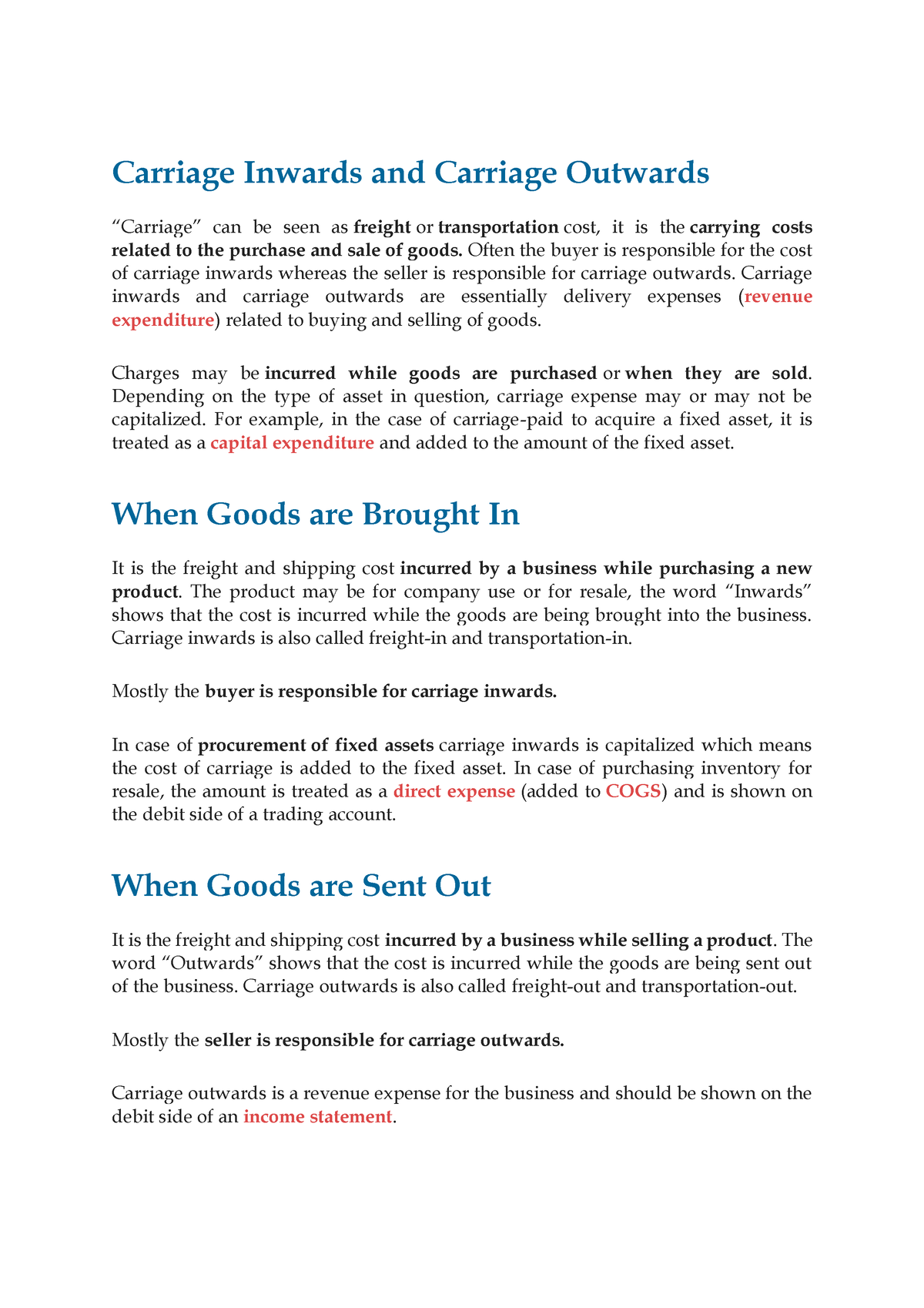

Carriage Inwards and Carriage Outwards NumberSquad

How carriage inwards and carriage outwards are recordedLindley Coetzee works in accounting and is a teacher by heart who has produced accounting and math DV.

What Is Carriage Inwards Carriage Inwards Freight Inwards Meaning Debit Or Credit / In

Carriage inwards refers to the cost of transporting goods from a supplier to the business. Suppliers → Carriage inwards → Business (Goods in)

Carriage Inwards in Statement DamonrilMaynard

Carriage inwards is the cost of transportation a business (buyer) pays to the supplier when the supplier delivers goods at their place. This cost depends on the transportation mode (air, road, or water), traveling distance, and nature of the goods. In business, it may also refer to the cost of purchasing assets and stocks.

Difference Between Carriage Inwards And Carriage Outwards

Carriage refers to the cost of transporting goods into a business from a supplier, as well as the cost of transporting goods from a business to its customers. Definition of Carriage Inwards Carriage inwards is the shipping and handling costs incurred by a company that is receiving goods from suppliers.

Carriage Inwards in Statement

The term "carriage inwards" refers to the expense that is spent whenever a company receives incoming goods. Carriage inwards is usually payable on a variety of inputs and raw ingredients that the buyer purchases from manufacturing entities and also on final items purchased from trade companies.

What is Carriage Inwards and Carriage Outwards Carriage Inwards and Carriage Outwards Studocu

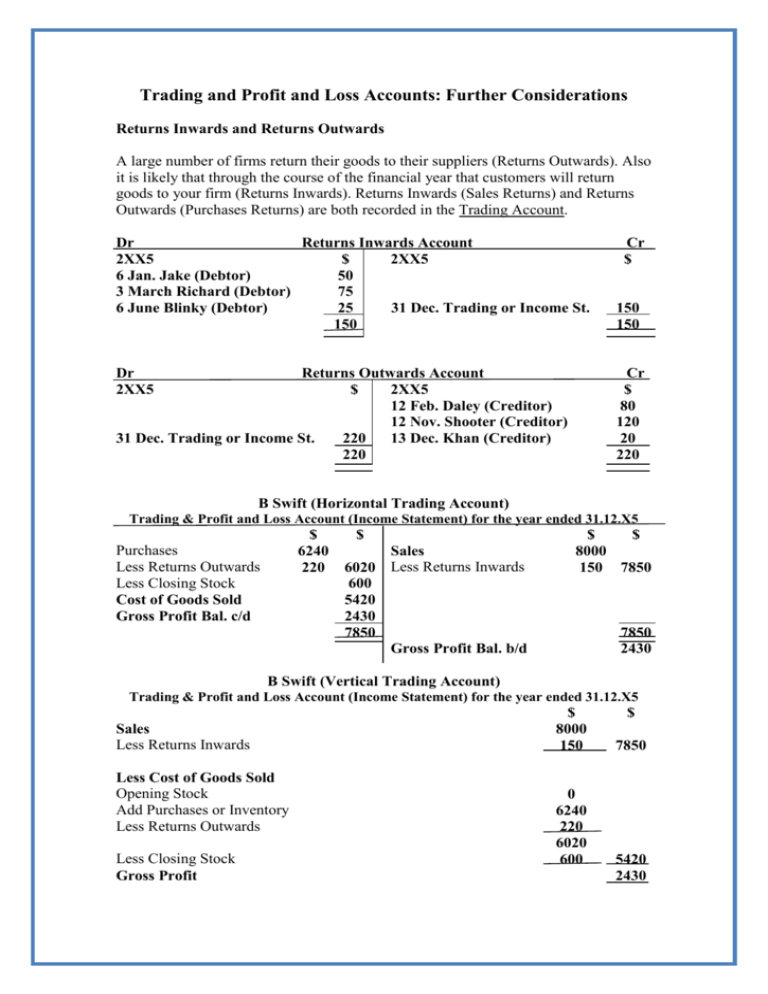

Carriage inwards and carriage outwards are two different types of expenses incurred by a company while buying and selling goods. They may be treated alike inside a trial balance, however, there is a clear difference between carriage inwards and carriage outwards.

Guide to Carriage Inwards and its Meaning. Here we discuss examples of freight inwards along

When Goods are Sent Out It is the freight and shipping cost incurred by a business while selling a product. The word "Outwards" shows that the cost is incurred while the goods are being sent out of the business. Carriage outwards is also called freight-out and transportation-out. Mostly the seller is responsible for carriage outwards.

Carriage Inwards (Freight Inwards) Meaning, Debit or Credit

Carriage inwards refers to the transportation costs required to be paid by the purchaser when it receives merchandise it ordered with terms FOB shipping point. Carriage inwards is also known as freight-in or transportation-in. Carriage inwards is considered to be part of the cost of the items purchased.

What Is Carriage Inwards / Prepare The Statement Andy Fleming Has Been Preparing His

Carriage inwards is the freight and carrying cost incurred by a business while acquiring a new product. Journal entry for carriage inwards depends on the item and the intent behind its usage. The product may or may not be for resale, the word "Inwards" shows that the cost is incurred while the goods are being brought into the business.

What Is Carriage Inwards Carriage Inwards Freight Inwards Meaning Debit Or Credit / In

Definition of Carriage Inwards. Carriage Inwards is also referred to as Freight in. It is the cost of carriage incurred by a supplier for receiving goods or raw materials from their supplier (s) - Carriage Inwards is always borne by the supplier. The accounting treatment for Carriage Inwards is to add it to the cost of purchasing the product.